Find Out 23+ Truths About Low Risk Option Strategy People Did not Tell You.

Low Risk Option Strategy | This is a complex options trading strategy that is low risk. It produces severely depressed prices for businesses. Before initiating a long strap, a trader should first identify an equity with elevated volatility prospects and a bullish expectational analysis backdrop. Learn the butterfly spread strategy, one of the most common options trading spread strategies. It is the cost of the option.

Many will tell you that selling call options is particularly risky because the potential losses are unlimited. Stronger or weaker directional biases. The strategy for a scheduled options payday each quarter. There are many options strategies that both limit risk and maximize return. Does anything like this exist at all?

Also, low effort posts are subject to removal. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. An additional, associated strategy, is starting by selling the put at a higher than current market limit price. A knife or a gun? Following are ten great trading option strategies. How to implement the long strap options strategy. Many will tell you that selling call options is particularly risky because the potential losses are unlimited. The strategy for a scheduled options payday each quarter. Before initiating a long strap, a trader should first identify an equity with elevated volatility prospects and a bullish expectational analysis backdrop. Another strategy utilized by investors is the stock collar. This is a complex options trading strategy that is low risk. Give sufficient details about your option strategy and trade to discuss it. Here are 10 options strategies that every investor should know.

The straddle trading strategy an options straddle blows some traders' minds. 7 ways to find stocks using low risk investment strategies. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. An optimal scenario occurs when you can buy the stock and long put during low volatility conditions. It is a kind of options spread where far month option is bought and near month option is sold.

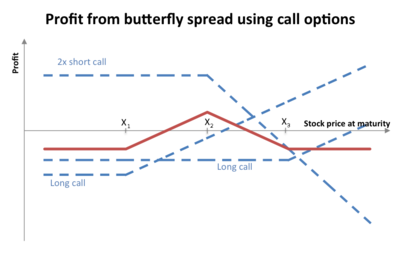

I like combining my options. Trading options is about more than just being bullish or bearish or market neutral. Besides not trading options at all, what is the options trading strategy with the least amount of risk (and i assume the least reward)? Risk graphs not only are signatures for the different option trading strategies but are also dynamically constructed to enable option traders using complex combination option trading strategies to better understand the net effect to one's portfolio at various prices. There has to be some way to earn single digit returns with options, everything i see seems to be. Options often get a bad rap as risky investments. It is a kind of options spread where far month option is bought and near month option is sold. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. 4 low risk butterfly trades for any market. 7 ways to find stocks using low risk investment strategies. Diagonal spread is one of the proven low risk options strategy. Traders can utilize several options to limit their risk and increase their chances of making a return. Zackstrade and zacks.com are separate companies.

The strategy for a scheduled options payday each quarter. Another strategy utilized by investors is the stock collar. Zackstrade and zacks.com are separate companies. There are many options strategies that both limit risk and maximize return. We will assume on expiry.

5 options trading strategies that are less risky than buying and selling stock. 7 ways to find stocks using low risk investment strategies. Risk graphs are therefore an. There are many options strategies that both limit risk and maximize return. Traders can utilize several options to limit their risk and increase their chances of making a return. Give sufficient details about your option strategy and trade to discuss it. An options trading strategy not only defines how you will enter and exit trades, but can help you manage risk and volatility. The wheel strategy is a powerful options strategy that employs your money to work for you. The common thread here is that they have limited risk and are alternatives for you to consider. Also, low effort posts are subject to removal. Trading options is about more than just being bullish or bearish or market neutral. Using options as a strategic investment. Timing this strategy's execution is a worthy goal.

Low Risk Option Strategy: 4 low risk butterfly trades for any market.

Source: Low Risk Option Strategy